Harvard endowment management plays a crucial role in shaping the financial landscape of Harvard University, which boasts an astounding endowment valued at over $53 billion. This considerable sum offers flexibility in addressing the university’s immediate needs while supporting long-term budgeting goals. However, it also brings inherent university endowment risks, as a significant portion of the funds is restricted by donors and not readily available for operational expenditures. Effective endowment strategies are essential for ensuring the continued support of financial aid funding and sustainable growth amidst uncertain economic conditions. As Harvard navigates the complexities of its finances, the management of its endowment becomes ever more critical for the institution’s future success.

The oversight of Harvard’s vast investment portfolio involves meticulous financial planning and strategic decision-making, commonly referred to as endowment governance. This includes not only managing the distribution of funds but also effectively handling financial uncertainties, which can impact the university’s capacity to fund various initiatives. The intricate nature of university investments requires a keen understanding of potential risks and opportunities that arise in education financing. With an emphasis on longevity, sound fiscal management enables Harvard to secure vital resources for student support and academic programs. Thus, the conversation surrounding the stewardship of Harvard’s financial assets extends beyond immediate gains, focusing instead on sustainable practices that foster growth and stability.

Understanding Harvard University’s Endowment Management

Harvard University’s endowment management is a critical financial strategy that provides a robust framework for balancing immediate operational needs with long-term financial stability. With an endowment valued at approximately $53 billion, it is essential to recognize that the actual spending capacity is limited by donor restrictions and budgetary planning. Only a small percentage of the endowment remains unrestricted, which means that effective management is essential to navigate potential challenges in university funding, especially in uncertain economic climates.

Economist John Y. Campbell emphasizes the importance of adopting a comprehensive approach to endowment management beyond just addressing current cash flow needs. By anticipating long-term budgeting requirements and setting realistic spending targets, the university can ensure resource availability for future generations of students and faculty. This proactive approach not only mitigates risks associated with financial fluctuations but also sustains Harvard’s commitment to offering substantial financial aid, a vital component of its operational success.

The Risks and Benefits of University Endowment Strategies

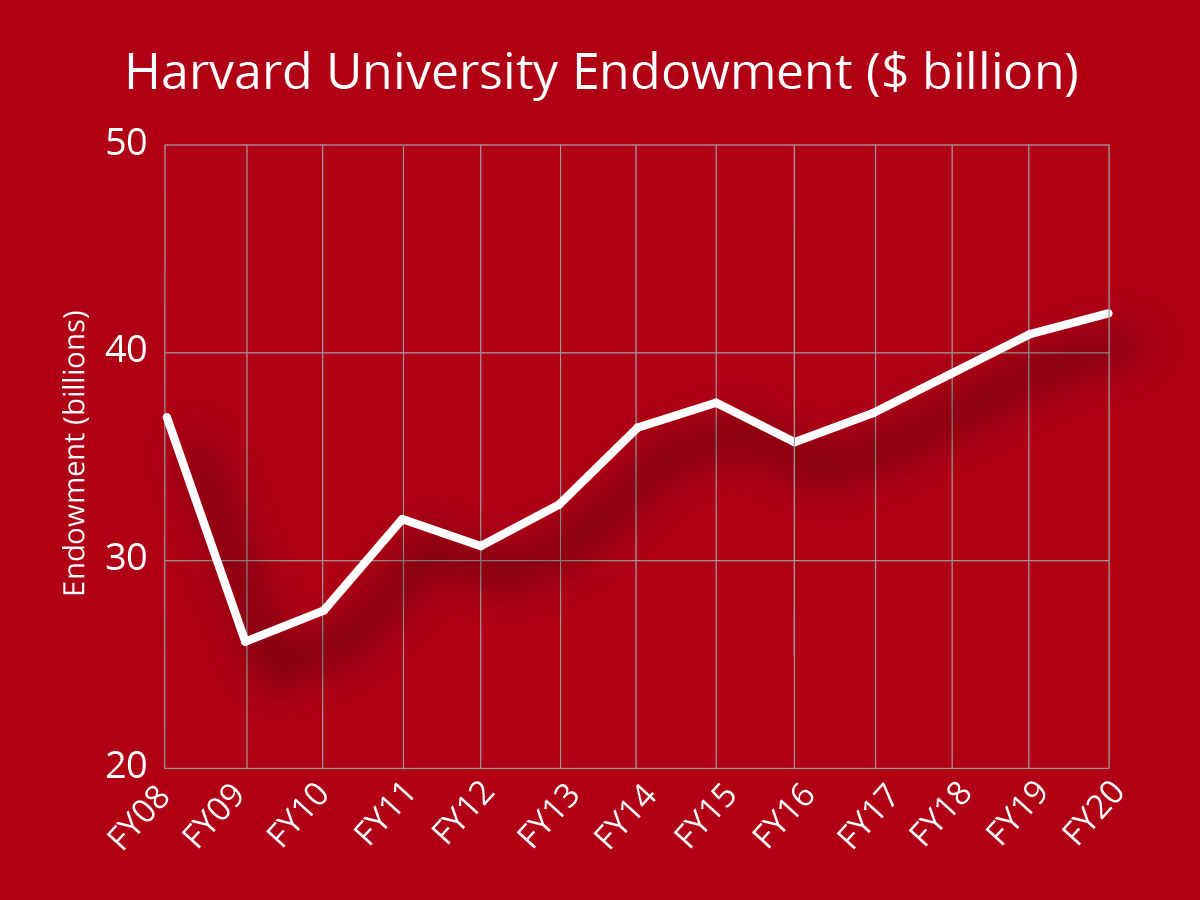

While the endowment provides financial flexibility, it also presents various risks that must be managed carefully. For instance, market volatility can lead to significant fluctuations in endowment value, as evidenced by losses during the 2009 financial crisis. Such risks necessitate a strategic approach to endowment withdrawals; relying too heavily on current funding can jeopardize the endowment’s long-term health. Consequently, university leaders must be disciplined in their financial decision-making to ensure that they do not compromise future funding availability.

Another crucial element of endowment strategy involves understanding the balance between leveraging existing funds for immediate needs versus preserving capital for future growth. While it may seem tempting to increase spending to alleviate budget deficits, this can lead to tighter budgets down the road, as highlighted by Campbell. Long-term budgeting must account for the potential of decreased endowment payouts and consider diversifying revenue sources to sustain financial aid commitments and operational costs.

Impact of Federal Funding Changes on Harvard’s Endowment

Recent political movements have put federal funding for universities, including Harvard, at risk, adding an additional layer of complexity to endowment management. The proposed freezing of long-term research grants could have lasting consequences for the university’s financial stability. This uncertainty requires Harvard to revisit its endowment management strategies, ensuring resilience against such external pressures that threaten financial aid funding and operational budgets.

In responding to this shifting landscape, university leaders are tasked with developing adaptive strategies that prioritize sustainable funding models. Conducting thorough scenario analyses, as suggested by economic frameworks, will help Harvard evaluate potential outcomes and prepare for varying degrees of financial impact. Such preparedness is vital, as it allows Harvard to navigate challenges while safeguarding education quality and financial aid offerings.

Navigating the Challenges of University Endowment Risks

Harvard University’s endowment is not just a financial asset but a critical lifeline for its operations, influencing everything from faculty salaries to maintaining cutting-edge research programs. However, management of this sizable fund comes with inherent risks. With a significant portion of the endowment restricted by donor designations, it is crucial for Harvard to maintain transparency and accountability in how these funds are utilized, thereby ensuring that they align with the university’s mission while addressing immediate needs.

Financial crises and unforeseen global events, like the COVID-19 pandemic, exemplify how even well-managed endowments can face significant pressures. As explained by Campbell, the reliance on the endowment for current expenses can exacerbate future budget constraints. Therefore, institutions must develop robust contingency plans that allow them to adapt without compromising long-term sustainability. Prioritizing strategic investments and fostering alternative revenue streams can cushion the impact of volatility in the market, securing the university’s ability to fulfill its educational mandate.

Long-Term Budgeting Goals for Harvard’s Endowment

Long-term budgeting plays a vital role in ensuring that Harvard can effectively generate financial aid funding and maintain its reputation as a leading educational institution. The university aims for a balance between spending from the endowment and reinvesting to promote future growth. By implementing a structured approach to set realistic expectations for returns and distributions, Harvard can prioritize financial stability alongside its commitment to educational excellence.

Moreover, adopting a comprehensive long-term budgeting strategy not only helps mitigate the risks associated with fluctuating endowment values, but also enhances the university’s resilience against changing financial landscapes. Engaging with stakeholders across the university—faculty, administrators, and donors—can foster a shared understanding of the financial framework while aligning short-term operational needs with long-term goals for sustainability and growth.

Endowment Strategies: A Framework For Future Sustainability

As the landscape of university funding evolves, Harvard’s endowment strategies must continuously adapt to ensure long-term sustainability. This includes re-examining traditional payout models and exploring innovative financial practices to optimize growth potential while minimizing risks. Harvard’s leadership must remain vigilant to external factors that may threaten funding sources, including shifts in government policy and economic conditions that may affect the overall investment climate.

The importance of a clear framework for managing Harvard’s endowment cannot be overstated. A proactive approach supports not only the university’s immediate financial health but also secures resources for enhancing educational opportunities in the future. By prioritizing responsible investing and identifying potential risks early, Harvard can create a resilient financial environment that supports its mission to deliver world-class education and research.

The Role of Harvard Management Company in Endowment Oversight

The Harvard Management Company (HMC) plays a pivotal role in overseeing the university’s endowment, implementing investment strategies that aim to generate stable returns while managing risk. With an experienced team of financial analysts and investment professionals, HMC must navigate an increasingly complex financial landscape, balancing the need for immediate liquidity against the necessity for long-term growth. Their expertise is critical in determining the right asset allocation that aligns with the university’s overall financial goals.

Furthermore, HMC’s strategic decisions directly impact the funding available for critical initiatives such as research, faculty appointments, and student support services. By focusing on sustainable investment practices, HMC not only enhances the university’s financial health but also underscores its commitment to ethical and socially responsible investing. This alignment with Harvard’s broader values reinforces public trust and confidence in the university’s financial stewardship, ultimately benefiting its stakeholders.

Balancing Immediate Needs and Long-Term Resources

In the realm of university finance, balancing immediate needs with long-term resources is a delicate act that requires astute management of the endowment. Harvard stands at the forefront of this challenge, leveraging its substantial resources while grappling with strategic choices that impact future financial health. As immediate demands surge, particularly amid financial uncertainties, the pressure to draw more from the endowment can be alluring but fraught with consequences.

John Y. Campbell’s insights highlight the importance of reframing the narrative around endowment spending. Rather than viewing the endowment as an all-encompassing resource, stakeholders must appreciate its intricacies, including restrictions imposed by donor intentions. Effective communication about these nuances can cultivate a deeper understanding within the Harvard community, fostering a culture of prudent financial management that prioritizes sustainable growth while addressing current operational needs.

The Future of Harvard’s Endowment Amid Economic Uncertainty

As economic uncertainty looms on the horizon, imagining the future of Harvard’s endowment requires strategic foresight and resilience. With the potential for shifts in federal funding, market volatility, and changing donor expectations, the university must be prepared to navigate these challenges effectively. This means taking a proactive stance in engaging with stakeholders on financial priorities, ensuring that the endowment remains robust even amidst turbulent fiscal conditions.

Additionally, cultivating transparent communication with faculty, students, and donors about the status of the endowment will be paramount. By fostering a culture of collaboration and education around endowment dynamics, the university can inspire confidence among its stakeholders. Emphasizing a long-term vision, coupled with adaptive financial strategies, will allow Harvard to continue leading the way in higher education, ensuring both current and future generations benefit from its storied legacy.

Frequently Asked Questions

How does Harvard endowment management influence the University’s finances?

Harvard endowment management plays a crucial role in the University’s finances by providing funding for various operations, including professorships, research, and financial aid. With an endowment currently valued at $53 billion, effective management helps ensure that resources are available for both immediate needs and long-term budgeting.

What risks are associated with Harvard University’s endowment strategies?

The risks associated with Harvard University’s endowment strategies include the potential for reliance on restricted funds, economic downturns that can impact investment returns, and political uncertainties which may affect funding and donations. Proper management is essential to mitigate these risks and protect financial aid funding.

How does Harvard endowment management affect its financial aid funding?

Harvard endowment management directly impacts financial aid funding as about 20% of the annual endowment distribution is allocated to support generous financial aid programs. This ensures that the University can provide access to education while balancing the long-term sustainability of its resources.

What are the long-term implications of Harvard University’s endowment management?

The long-term implications of Harvard University’s endowment management include maintaining financial stability, adapting to potential budget deficits, and ensuring that funds are available for future investments in education and research. A well-managed endowment helps safeguard against economic fluctuations and enhances the University’s financial resilience.

Why is understanding Harvard endowment risks important for stakeholders?

Understanding Harvard endowment risks is important for stakeholders, including students, faculty, and donors, as it highlights how financial decisions impact the University’s operations and funding capabilities. Awareness of these risks promotes informed discussions about the sustainability of programs and the financial health of Harvard University.

What are some strategies Harvard uses in endowment management to ensure long-term budgeting?

Harvard employs various endowment management strategies to ensure long-term budgeting, including smoothing out investment returns over time, conservative spending policies, and scenario analysis to prepare for potential economic changes. These strategies aim to balance immediate financial needs against the sustainability of the endowment for future generations.

How does the restricted nature of Harvard’s endowment affect its funding allocations?

The restricted nature of Harvard’s endowment limits how funds can be allocated, meaning that a significant portion is earmarked for specific purposes. This restriction creates challenges in accessing funds for immediate operational needs and underscores the importance of careful planning in endowment management to address both current and future expenses.

What is the role of Harvard Management Company in overseeing the endowment?

The Harvard Management Company plays a vital role in overseeing the endowment by managing investments, strategizing asset allocation, and assessing risks to ensure that the endowment performs effectively. Their expertise is crucial for optimizing returns and ensuring that funds remain available for Harvard’s long-term financial needs.

| Key Points | Details |

|---|---|

| Record Endowment Value | Harvard began the fiscal year with an endowment valued at $53 billion. |

| Restricted Funds | Most of the endowment is restricted by donors and allocated to the University’s 12 schools. Less than 5% is unrestricted. |

| Financial Relief and Risks | Endowments offer financial relief but using them increases long-term risks and reduces future available resources. |

| Impact of Recent Conflicts | The Trump administration’s freeze on research grants jeopardizes funding and impacts endowment use. |

| Long-term Planning | The endowment must be managed with future needs in mind and not just immediate cash flow needs. |

| Volatility Management | Harvard’s approach involves smoothing out performance over time to manage market volatility. |

| Scenario Analysis | Leadership must use analytical frameworks to assess long-term impacts of financial shifts, considering potential funding losses. |

Summary

Harvard endowment management plays a pivotal role in ensuring financial stability for the University. The recent discussions highlight the balancing act between leveraging the endowment for immediate operational needs while safeguarding against potential long-term risks associated with dependency on restricted funds and external funding fluctuations. Insightful strategies, as outlined by experts, emphasize the importance of cautious planning and diversified revenue sources to strengthen Harvard’s financial resilience.